Markets reward pragmatic innovators, and smart investors recognize that.

There’s no better example than this cover story in IHS Chemical Week, which profiles how Berkshire Hathaway’s 2011 acquisition of one company, Lubrizol, for $9.7 billion has powered expansion and diversification that’s included a significant foray into specialty chemicals and advanced materials.

The global surge in anti-aging and personal care products will support the specialty chemicals business at companies like Lubrizol and others, and that’s certainly an attraction for Berkshire’s chairman, Warren Buffett, an avowed proponent of investing in companies in markets where there are long-term opportunities for steady growth and returns.

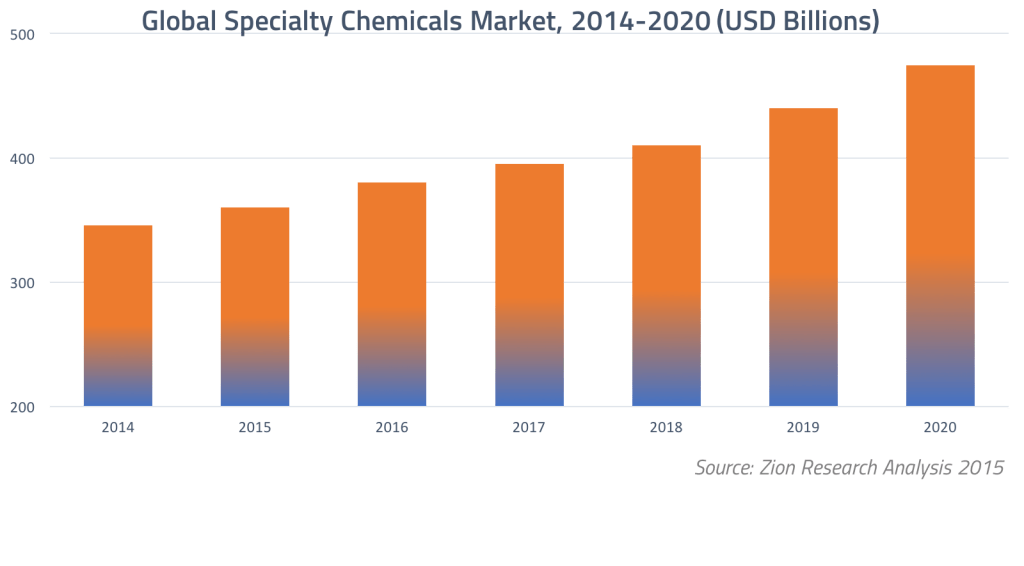

That potential is absolutely reflected in analysts’ projections for specialty chemical growth…

Supporting a long-term outlook

Buffett is apparently very bullish about chemicals. He’s bought up 3% of Lanxess, rumored to be his next takeover target.

The benefit of a supportive yet largely hands-off owner like Buffett to a specialty chemicals company? It allows them to focus on long-term strategy and thinking, versus the short term. A big component of that is making long-range decisions about how you’re benefitting the millions of consumers who are embracing your products.

Companies like these, supported by shrewd backers like Buffett, are expanding their portfolios and market coverage because the specialty chemicals business offers tremendous opportunities for smart players who know how to position themselves. And, just as importantly, value innovation as the fuel for ongoing growth.

That innovation compounds success for everyone, even competitors, as consumers rush to embrace fresh ideas and new formulations.